CLAIM: Sen. DeMint Falsely Claimed That Restoring Top Tax Rates To Clinton-Era Levels Would "Raise Taxes On 750,000 Small Businesses"

SEN. JIM DEMINT (R-SC): I don't think there's any room to negotiate on raising taxes, particularly on small businesses. I hope we can get a permanent extension, but if the president wants to compromise on a two or three year extension...We'll work with him on that, but I hope he doesn't come back with the idea that, oh we're gonna raise taxes on 750,000 small businesses as, as he's been talking about, um, uh, I think if he can work on our side of the ledger, I think uh we might can work together.

FACT: DeMint's Definition Of "Small Businesses" Includes Industry-Leading Corporations Worth Tens Of Billions

To Arrive At 750,000 Claim, Republicans Define All "Pass-Through" Entities As Small Businesses. As reported by the Washington Post, "Republicans continually define pass-through entities of all sizes as small businesses..." [Washington Post, 9/17/10; emphasis added]

By Defining All "Pass-Through" Entities As "Small Businesses," Republicans Are Counting A Wall Street Firm Worth $54 Billion As "Small."Washington Post: As reported by the

The thing is, some of those businesses are not particularly small. In fact, they're quite large.

Among the firms Republicans want to protect from new taxes, according to research by House Democrats: The management team at Wall Street buyout firm Kohlberg, Kravis and Roberts (KKR), which recently reported more than $54 billion in assets managed by 14 offices around the world. Auditing firm PricewaterhouseCoopers, a household name with operations in more than 150 countries. And the Tribune Corp., which owns the Chicago Tribune, the Los Angeles Times and the Baltimore Sun.

KKR, PricewaterhouseCoopers and the Tribune, it turns out, are organized as "pass-through" entities - companies that typically avoid corporate taxes by reporting profits on the individual tax returns of their owners, managers or shareholders. [Washington Post, 9/17/10; emphasis added]

Bush Economist: Businesses Republicans Define As "Small" Are Actually "Very Large." According to the Washington Post: "Alan Viard, an economist in the Bush White House who is now at the American Enterprise Institute, agreed that many firms represented in the top tax brackets are hardly small. Economically, that doesn't matter, he said: Obama would still be raising taxes on a significant source of jobs and economic activity. Politically, however, it's a very different matter to raise taxes on a Wall Street hedge fund than it is to tax your neighborhood dry cleaner. Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position Viard called a 'fallacy.' 'How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they're owning can't be all that small,' Viard said. 'And that's true. They're very large.'" [Washington Post, 9/17/10; emphasis added]

- Just 12 Percent Of Money Raised By Increasing Top Rates Comes From "Small Businesses With Actual Workers." As reported by Businessweek: "The nonpartisan Congressional Research Service, which analyzes issues for lawmakers, largely agreed with Obama in a Sept. 3 report that considered only taxpayers with employees. Its conclusion: Small businesses with actual workers would pay only about 12 percent of the higher taxes. 'Across-the-board tax cuts for high-income individuals are not efficiently targeted to small businesses,' wrote author Jane G. Gravelle." [Businessweek, 9/23/10; emphasis added]

Republican Definition Includes Athletes, Authors, And Other Non-Employer Tax Filers. According to Businessweek: "McConnell's 50-percent-of-income figure is based on a July 12 finding by the Joint Committee on Taxation, a House-Senate panel that analyzes tax issues, that half of about $1 trillion of business income in 2011 will be reported on some 750,000 personal tax returns filed by people who pay the top marginal rates. He calls those small businesses. Yet the report says the data 'do not imply that all of the income is from entities that might be considered 'small.'' Almost 20,000 of those businesses, for example, had receipts of more than $50 million, it says. Besides Obama, McConnell's 50 percent figure includes authors, actors, athletes, and others who employ few if any workers, as well as hedge fund firms and major law partnerships most people wouldn't consider small. 'We are being over-inclusive in our use of small business income,' says Edward D. Kleinbard, a former staff director of the Joint Committee on Taxation who is now a University of Southern California law professor." [Businessweek, 9/23/10; emphasis added]

For Political Correction's previous coverage of Republican misinformation about small business taxes, see HERE, HERE and HERE.

CLAIM: Sen. DeMint Claimed U.S. Corporate Taxes Are Among The Highest In The World

SEN. JIM DEMINT (R-SC): We don't have a taxing problem in this country. We already have one of the highest corporate tax rates in the world. We need to cut spending.

FACT: DeMint Ignored The Tax Rates U.S. Corporations ACTUALLY Pay, Which Are Much Lower

Effective Tax Rates Are Lower Than Statutory Rates. In its 2009 report on global taxation, the World Bank wrote: "The key point to recognise is that it is not simply the statutory rate of corporate income tax that is important here, but also the effective tax rate for current corporate income tax, taking into account all the additions and deductions to profit before tax that tax rules may require." ["Paying Taxes 2009: The Global Picture," World Bank, 11/10/08]

American Companies Pay Lower Effective Tax Rate Than German, Canadian, Chinese, Italian, And Other Companies. In its 2009 report on global taxation, the World Bank wrote:

As noted in Chapter 1, reducing the statutory rate of corporate income tax has been the most popular government tax reform in the period. However in most of the economies, the case study company does not pay corporate income tax at the statutory rate on its profit before tax, since the tax rules require adjustments to be made to this in order to calculate taxable profits. A common example is to substitute tax depreciation for commercial amortisation of assets.

The effective rate of current corporate income tax can be defined as the actual rate of corporate income tax paid as a percentage of profit before tax. Figure 2.7 compares this effective rate with the statutory rate of corporate income tax for the G8 and BRIC (Brazil, Russia, India and China) economies, and shows that the two are often not the same...

["Paying Taxes 2009: The Global Picture," World Bank, 11/10/08; in-text citation removed for clarity]

CBPP: U.S. Corporations Pay Lower Taxes Than Average For Developed Economies. According to the Center for Budget and Policy Priorities: "The U.S. corporate tax burden is smaller than average for developed countries. Corporations in 19 of the member states of the Organization for Economic Co-operation and Development paid 16.1 percent of their profits in taxes between 2000 and 2005, on average, while corporations in the United States paid 13.4 percent." [CBPP.org, 10/27/08; in-text citation removed for clarity]

2009: General Electric Earned A $1.1 Billion Tax CREDIT Despite $10.3 BILLION In Pre-Tax Income. According to Forbes: "As you work on your taxes this month, here's something to raise your hackles: Some of the world's biggest, most profitable corporations enjoy a far lower tax rate than you do--that is, if they pay taxes at all. The most egregious example is General Electric. Last year the conglomerate generated $10.3 billion in pretax income, but ended up owing nothing to Uncle Sam. In fact, it recorded a tax benefit of $1.1 billion. Avoiding taxes is nothing new for General Electric. In 2008 its effective tax rate was 5.3%; in 2007 it was 15%. The marginal U.S. corporate rate is 35%." [Forbes, 4/1/10; emphasis added]

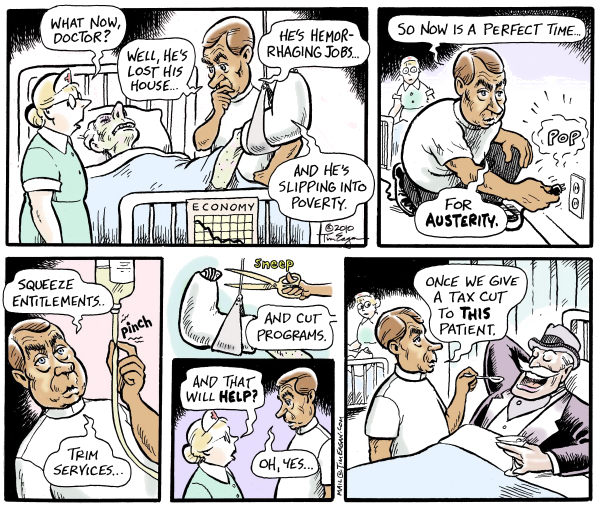

CLAIM: Sen. McCain Suggested That Continuing Tax Breaks For The Wealthy Will Help The Economy

SEN. JOHN MCCAIN (R-AZ): We're in the midst of the greatest recession in the history of this country since the Great Depression. It is not the time to raise anyone's taxes.

FACT: Cutting Taxes For The Wealthy Does Little To Stimulate The Economy

Bloomberg News: "Give The Wealthiest Americans A Tax Cut And History Suggests They Will Save The Money Rather Than Spend It." According to Bloomberg News: "Give the wealthiest Americans a tax cut and history suggests they will save the money rather than spend it. Tax cuts in 2001 and 2003 under President George W. Bush were followed by increases in the saving rate among the rich, according to data from Moody's Analytics Inc. When taxes were raised under Bill Clinton, the saving rate fell. The findings may weaken arguments by Republicans and some Democrats in Congress who say allowing the Bush-era tax cuts for the wealthiest Americans to lapse will prompt them to reduce their spending, harming the economy. President Barack Obama wants to extend the cuts for individuals earning less than $200,000 and couples earning less than $250,000 while ending them for those who earn more." [Bloomberg News, 9/14/10]

New York Times: "Research Suggests That Tax Cuts... Have Limited Ability To Bolster The Flagging Economy." According to the New York Times: "The concept of lower taxes is so appealing to voters that many embrace them as an economic cure-all. But economic research suggests that tax cuts, though difficult for politicians to resist in election season, have limited ability to bolster the flagging economy because they are essentially a supply-side remedy for a problem caused by lack of demand. The nonpartisan Congressional Budget Office this year analyzed the short-term effects of 11 policy options and found that extending the tax cuts would be the least effective way to spur the economy and reduce unemployment. The report added that tax cuts for high earners would have the smallest 'bang for the buck,' because wealthy Americans were more likely to save their money than spend it." [New York Times, 9/11/10]

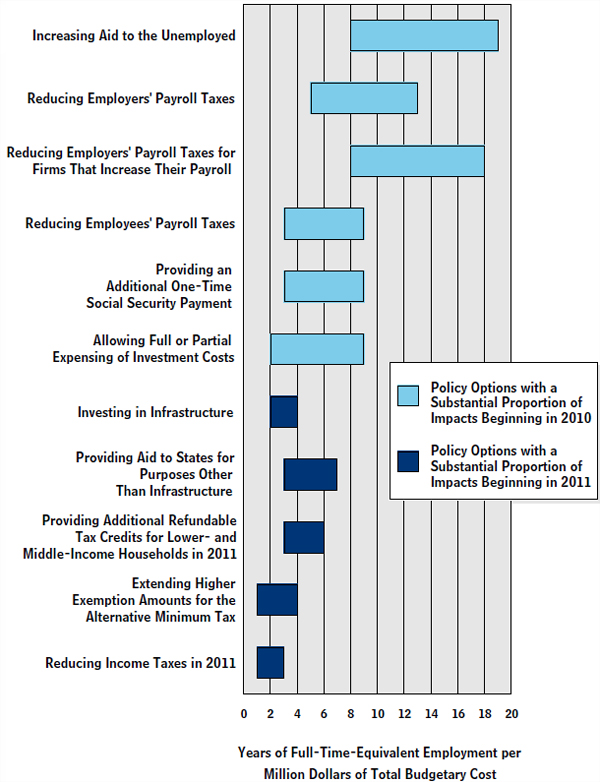

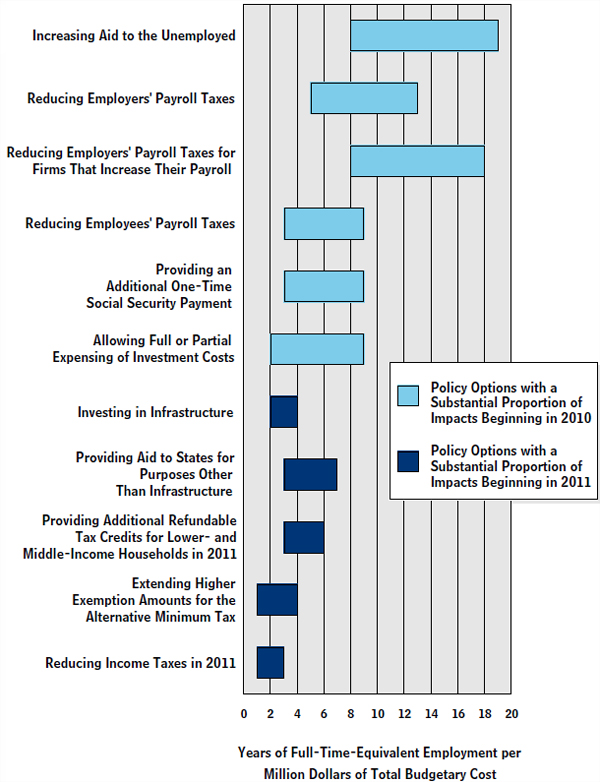

CBO: Among Eleven Proposals To Spur Economic Growth, Cutting Income Taxes Ranks Last. Below is a chart created by the Congressional Budget Office to show the "cumulative effects of policy options on employment in 2010 and 2011":

[Congressional Budget Office, 2/23/10]

CLAIM: Newt Gingrich Claimed Government Worker Earnings Are Out Of Proportion With Private-Sector Pay

NEWT GINGRICH: The only place I worry about in terms of the kind of riots you were showing is not Americans in general. I believe the scale of change coming to government workers is gonna be so great that you may well see in places like Sacramento or Albany, New York, very serious unrest by union members who are offended at the idea that they should actually earn in proportion to the taxpayer, and not be the new, uh, special class in America, which is what they've become over the last 20 years. [Meet the Press, 11/14/10]

CLAIM: Sen.-Elect Rand Paul Claimed Government Worker Compensation Is Almost Double That Of Private Sector Workers

RAND PAUL (R-KY): Really I think you should shrink the federal workforce, and you should make their pay more comparable. Right now the total compensation for government workers versus private workers is almost two to one. [Face the Nation, 11/14/10]

FACT: Government Workers Do Not Make Twice What Equivalent Private Sector Workers Make

In Some Professions, Government Pay Lower Than Private Sector Pay. As reported by PolitiFact.com: "When we checked individual jobs using the most recent Bureau of Labor Statistics employment data (from 2008), we found many federal salaries were indeed higher, but some were lower. Higher: A government-employed nurse makes about $74,460 on average, while someone in the same position working for the private sector makes about $65,130. A cashier working for the government makes on average $34,470 while a cashier working in a store only makes a mean of $18,880 annually. And a public-relations manager working for the government makes about $132,410 a year compared to $101,220 in the private sector. Lower: Petroleum engineers working for the government earn an average of $93,140; in the private sector, they make an average of $119,140. An editor working for the government only makes $42,210, compared to an average of $57,180 in the private sector." [PolitiFact.com, 1/31/10]

PolitiFact: Federal Pay Claim "False" Because "It Is Not An Apples-To-Apples Comparison." PolitiFact investigated a similar claim by Sen. Scott Brown (R-MA) in January 2010:

Secondly, it's important to understand that a big reason for the disparity is the different mix of jobs in the federal work force. It has more higher-paying white-collar jobs, experts told us, while there are more lower-paying, blue-collar jobs in the private sector that bring the average down. So it is not an apples-to-apples comparison.

Finally, we found it's a mixed bag when comparing individual private and public sector occupations -- the "private counterparts" he spoke of. Some public jobs pay more, some pay less. And the public ones that pay more are not consistently double as he claimed.

So he's wrong to say it's double and wrong to suggest that it's always the case when comparing specific jobs. We rate his claim False.

[PolitiFact.com, 1/31/10; emphasis added]

Disparity In "Average" Compensation Arises Because Federal Workforce Is More Educated, Skilled Than Private Sector Workforce. According to PolitiFact.com:

The first is that there's an imbalance in the types of jobs that make up the federal workforce compared to the private-sector workforce. The federal workforce is disproportionately composed of employees with higher educational attainment. Think of all the low-wage burger-flippers, gas station attendants and domestic workers in the private-sector economy. The federal government has some of these types of employees but proportionately far fewer -- especially after nearly two decades of aggressive contracting-out of duties that need not be handled by salaried federal employees. This has further expanded the federal government's disproportionately large numbers of lawyers, scientists and other highly skilled professionals.

If the federal sector today is hiring a lot of people with specialized expertise and the private sector is hiring a lot of people with skills that don't require a college, or even a high school, degree, then it's no surprise that the average salary levels in each sector are going to be at odds. [PolitiFact.com, 11/7/10; emphasis added]

CLAIM: Sen. Graham (R-SC) Claimed The New START Treaty Would Harm Efforts To Maintain Our Nuclear Arsenal

SEN. LINDSEY GRAHAM (R-SC): I'm very open-minded about the treaty...You got two impediments. Modernization. Not only do we need a START treaty, we need to modernize our nuclear force, the weapons that are left, to make sure they uh, continue to be a deterrent.

FACT: President Obama Has Requested 10% Boost In Funding For Missile Maintenance

President Obama's 2011 Budget Requests 10% Increase In Funding For Organization That Maintains Our Nuclear Stockpile. According to the Arms Control Association: "For Fiscal Year (FY) 2011, the Obama administration is requesting $7 billion, a 10 percent increase, in funding for weapons activities in the Department of Energy's National Nuclear Security Administration (NNSA), which oversees the U.S. nuclear stockpile and production complex. The administration plans to spend an additional $5 billion on NNSA nuclear weapons activities over the next five years." [Arms Control Association, 4/27/10]

We Are Constantly Modernizing Our Weapons Arsenal. As the Brookings Institution's Stephen Pifer explained, "We [the US] take a missile frame and we modernize it, and we refurbish it, whereas the Russian practice is to take a missile, they use it for 15 years and then they replace it completely. So you'll see new numbers coming up on the Russian side and you may think that, gosh, the Americans are still deploying these 1970s missiles. I suspect when they retire the last Minuteman III in 2030, it may have three of the original bolts on it from 1970 but it's going to be a very different missile." [Arms Control Association, 12/9/09, emphasis added]

- US Presently Has 5,113 Nuclear Warheads. As the Financial TimesFinancial Times, 5/4/10] reported, "In an announcement timed to coincide with the opening of the United Nations nuclear non-proliferation conference in New York, the Pentagon said it had a nuclear stockpile of 5,113 warheads as of September 30 2009." [

CLAIM: Sen. Graham (R-SC) Claimed The New START Treaty Would Impede Missile Defense Programs

SEN. LINDSEY GRAHAM (R-SC): I'm very open-minded about the treaty...You got two impediments. Modernization. Not only do we need a START treaty, we need to modernize our nuclear force, the weapons that are left, to make sure they uh, continue to be a deterrent. And we need to make sure that we can employ— deploy missile defense systems that are apart from START. So you got two stumbling blocks. The modernization program, and how uh, missile defense works apart from the treaty.

FACT: General In Charge Of Missile Defense Says START Will Help, Not Hinder, Missile Defense Efforts

Lt. Gen. Patrick O'Reilly: "The New START Treaty Has No Constraints On...The Ballistic Missile Defense System." In testimony before the House Armed Forces Subcommittee on Strategic Forces, Lt. Gen. Patrick O'Reilly said: "The New START Treaty has no constraints on current and future components of the BMDS development or deployment. Article V, Section 3 of the treaty prohibits the conversion of ICBM or SLBM launchers to missile defense launchers, and vice versa, while "grandfathering" the five former ICBM silos at Vandenberg AFB already converted for Ground Based Interceptors. MDA never had a plan to convert additional ICBM silos at Vandenberg and intends to hedge against increased BMDS requirements by completing construction of Missile Field 2 at Fort Greely. Moreover, we determined that if more interceptors were to be added at Vandenberg AFB, it would be less expensive to build a new GBI missile field (which is not prohibited by the treaty). Regarding SLBM launchers, some time ago we examined the concept of launching missile defense interceptors from submarines and found it an unattractive and extremely expensive option." [Gen. O'Reilly Testimony, 4/15/10]

Lt. Gen. Patrick O'Reilly: New START Treaty "Actually Reduces Constraints On The Development Of The Missile Defense Program." In testimony before the House Armed Forces Subcommittee on Strategic Forces, Lt. Gen. Patrick O'Reilly said: "Relative to the recently expired START Treaty, the New START Treaty actually reduces constraints on the development of the missile defense program. Unless they have New-START accountable first stages (which we do not plan to use), our targets will no longer be subject to START constraints, which limited our use of air-to-surface and waterborne launches of targets which are essential for the cost-effective testing of missile defense interceptors against MRBM and IRBM targets in the Pacific area. In addition, under New START, we will no longer be limited to five space launch facilities for target launches." [Gen. O'Reilly Testimony, 4/15/10]

- Lt. Gen. Patrick O'Reilly Serves As Director Of The Pentagon's Missile Defense Agency. According to his biography on the Missile Defense Agency website: "Lieutenant General Patrick J. O'Reilly is the Director for the Missile Defense Agency (MDA), Office of the Secretary of Defense, Pentagon, Washington, DC. In this capacity, he oversees MDA's worldwide mission to develop a capability to defend deployed forces, the United States, Allies, and friends against ballistic missile attacks." [MDA.mil, accessed 11/14/10]